Moderately Priced Dwelling Units (MPDUs) are affordably priced rental and for-sale homes provided to individuals and families with moderate incomes. These units are typically offered at prices or rents below market rate, making them more accessible to those who might not be able to afford standard housing options.

In Montgomery County, a minimum of 12.5% of units in a new development with at least 20 units is required. There are several circumstances where 15% MPDUs may be required, as outlined below.

Overview

Montgomery County’s MPDU program is one of the nation’s first mandatory, inclusionary zoning laws. It was implemented in 1973 to help meet the goal of providing a full range of housing choices in the county for all incomes, ages, and household sizes. As of 2024, the Department of Housing and Community Affairs (DHCA) has produced over 17,000 MPDUs in the county and tracks annual production.

- An MPDU is a county-regulated housing unit that must be affordable to households earning up to 65% of Area Median Income (AMI) for garden-style apartments and up to 70% for high-rise apartments and for-sale units.

- The MPDU program offers both rental and homeownership opportunities. Rental units are priced below market, while for-sale units are sold at reduced prices with restrictions to maintain long-term affordability.

- New private developments with at least 20 units must set aside a minimum of 12.5%, and up to 15%, of units as MPDUs for eligible households, with optional incentives like bonus density and additional height to provide more MPDUs.

- Residential projects with 11 to 19 units are not required to include MPDUs but must contribute to the Housing Initiative Fund (HIF) an amount equal to 0.5% of the purchase price of each unit.

While Montgomery County’s Department of Housing and Community Affairs (DHCA) largely implements and operates the MPDU program, Montgomery Planning and the Montgomery County Planning Board play an important role through land use and zoning approvals for new developments, the preliminary plan and site plan process, and master plan recommendations. As the county’s Public Housing Authority, the Housing Opportunities Commission also works to provide low- and moderate-income households the opportunity to live in high-quality, safe, and affordable housing through the MPDU program.

For more details about Montgomery County’s MPDU program and to learn how to apply as a renter or homeowner, visit DHCA’s website.

15% MPDU requirement

While the county has a 12.5% MPDU minimum requirement for new developments that have at least 20 units, there are several circumstances where 15% MPDUs may be required, as outlined below.

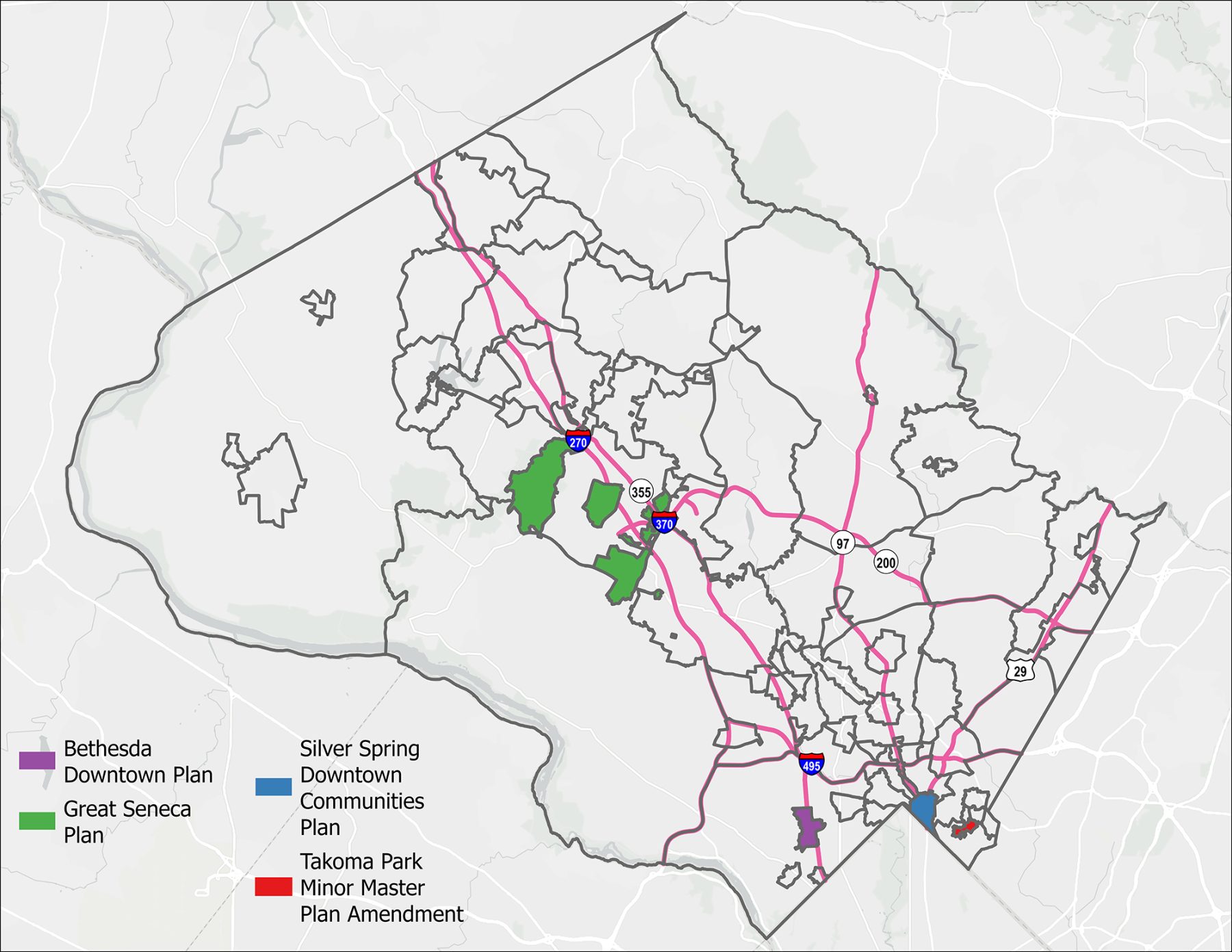

Master plan requirements

Full master plan designation

Under Chapter 25A, the Montgomery County Council may establish a higher minimum requirement of MPDUs as part of a master plan approval.

Example: The 2022 Silver Spring Downtown and Adjacent Communities Plan requires all optional method development projects within the plan area to provide a minimum of 15% MPDUs. The optional method of development is a process where developers can exceed standard zoning regulations, such as density and height restrictions, in exchange for specific public benefits to the community – in this case, MPDUs.

Site-specific designation

There may be instances where only certain sites within an approved master plan area are designated to have a higher MPDU requirement.

Example: While the 2020 Forest Glen/Montgomery Hills Sector Plan does not mandate 15% MPDUs at the full plan level, the Forest Glen Metro Station Parking Lot and entrance parcel require any optional method project that includes residential units to provide a minimum of 15% MPDUs.

Priority public amenity designation

Before master plans could explicitly require 15% MPDUs through the approval process, some sector and master plans used the priority public amenities system to select 15% MPDUs as the highest priority public amenity for residential development.

Example: The 2017 Rock Spring Sector Plan identifies 15% MPDUs as the highest priority public amenity for new residential development. This priority holds unless the property is required to dedicate land for a school or athletic fields that can be used by Montgomery County Public Schools and are approximately the size of a local park.

Overlay zone requirement

An overlay zone is mapped on top of an underlying base zone to modify existing requirements to achieve development or redevelopment goals. One possible change in an overlay zone could be to the MPDU requirement and incentives allowed for MPDUs.

Example: For any development application that includes at least 20 residential units within the Bethesda Overlay Zone, the Planning Board may only approve the application if the development provides at least 15% MPDUs.

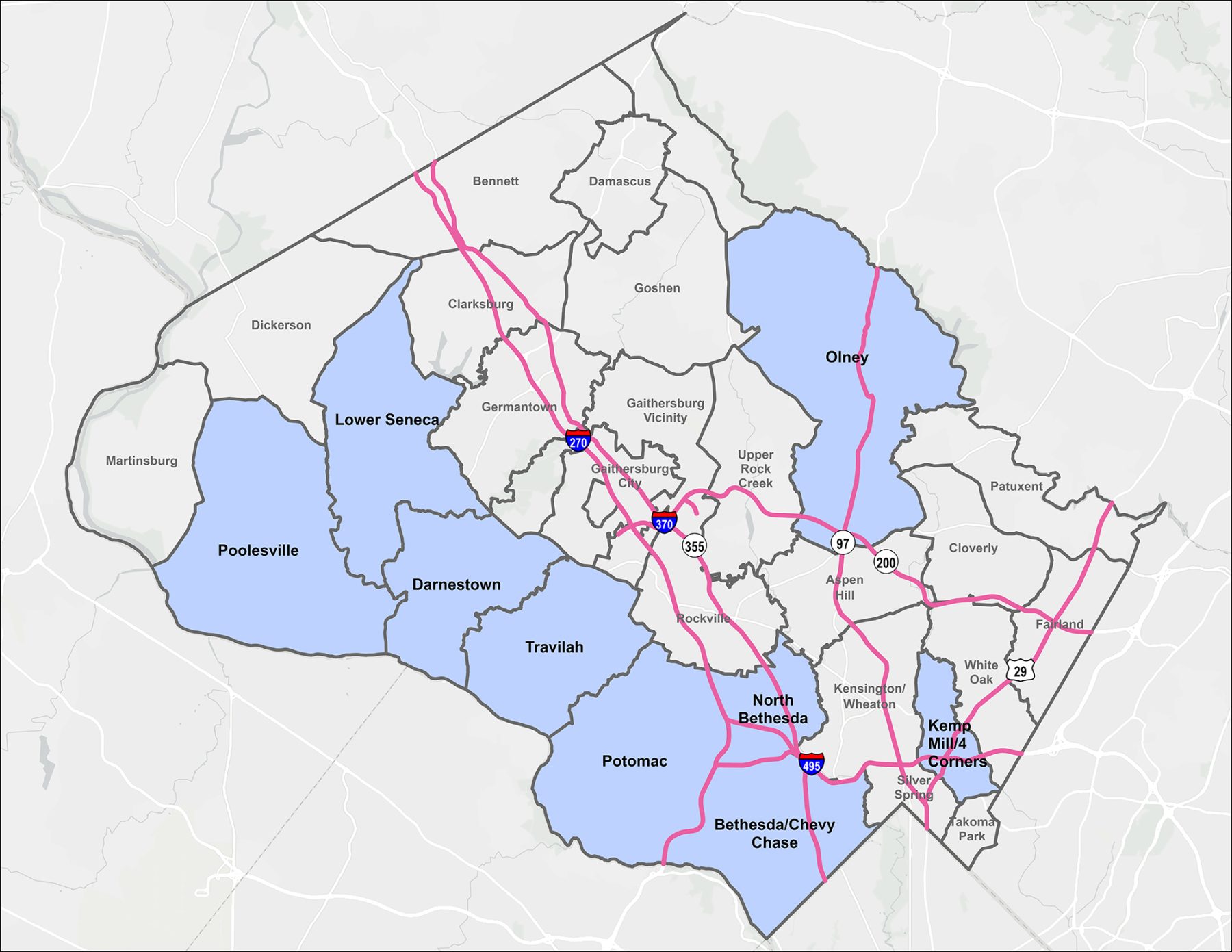

High-income Planning Area requirement

The county has 28 Planning Areas, which are geographic boundaries approved by the County Council in the 1930s to compare demographic information over time. Bill 38-17 passed in 2018 mandates a minimum of 15% MPDUs for developments in a Planning Area in which at least 45% of the acreage in the area’s U. S. Census Bureau tracts has a median household income of at least 150% of the countywide median household income at the time the Planning Board accepts an application as complete. The requirement for 15% MPDUs in specific Planning Areas must be designated by the Planning Board annually based on new median income data.

In 2025, the Planning Areas with a 15% MPDU requirement are:

- Bethesda/Chevy Chase

- Darnestown

- Kemp Mill/Four Corners (new in 2025)

- Lower Seneca

- North Bethesda

- Olney (new in 2025)

- Poolesville (new in 2025)

- Potomac

- Travilah

Frequently asked questions

To calculate which Planning Areas require 15% MPDUs, Montgomery Planning staff used data from the most recent five-year American Community Survey (ACS). Each census tract in the county was assigned to one Planning Area based on its geometric center and then aggregated with other census tracts assigned to that Planning Area to conduct the calculation.

According to the 2023 ACS data, Montgomery County had a median income of $128,733, meaning that 150% of the countywide median income was $193,100. Census tracts with a median income over $193,100 were identified, their total area in acres was summed, and this value was divided by the total area of all census tracts assigned to that Planning Area. If 45% or more of the census tract acreage in that Planning Area had a median income higher than $193,100, that Planning Area was designated with a 15% MPDU requirement.

While data at the census-tract level was used to determine MPDU designation, the 15% requirement is applied to the boundary of the Planning Area, not the aggregated census boundaries.

Example: 55% of the census-tract acreage in the North Bethesda Planning Area had a median income greater than $193,000, designating the entire Planning Area with a 15% MPDU requirement.

The requirement for 15% MPDUs in specific Planning Areas must be designated by the Planning Board annually in January based on new median income data from the ACS.

Bonus Density: The most commonly used incentive is bonus density. Chapter 59 (the Zoning Code) has a three-tiered bonus density system for going above 12.5% MPDUs.

Additional Height: If a project exceeds 12.5% MPDUs, the height limit of the applicable zone and master plan does not apply to the extent required to provide the MPDUs. If a project provides 25% MPDUs, the applicable school and transportation impact taxes are discounted by an amount equivalent to the lowest standard impact tax in the county for the applicable dwelling type.

As an example, impact taxes are generally the lowest in the infill impact areas (schools), and red policy areas (transportation). Projects with 25% MPDUs built in those areas will have all their impact taxes waived. Projects built in the turnover impact areas (schools) and orange, yellow, and green policy areas (transportation) would have school impact tax discounted by the amount of impact tax charged in infill impact areas and the transportation impact tax discounted by the amount of impact tax charged in red policy areas.