By Jason Sartori, Lisa Govoni, and Karen Blyton

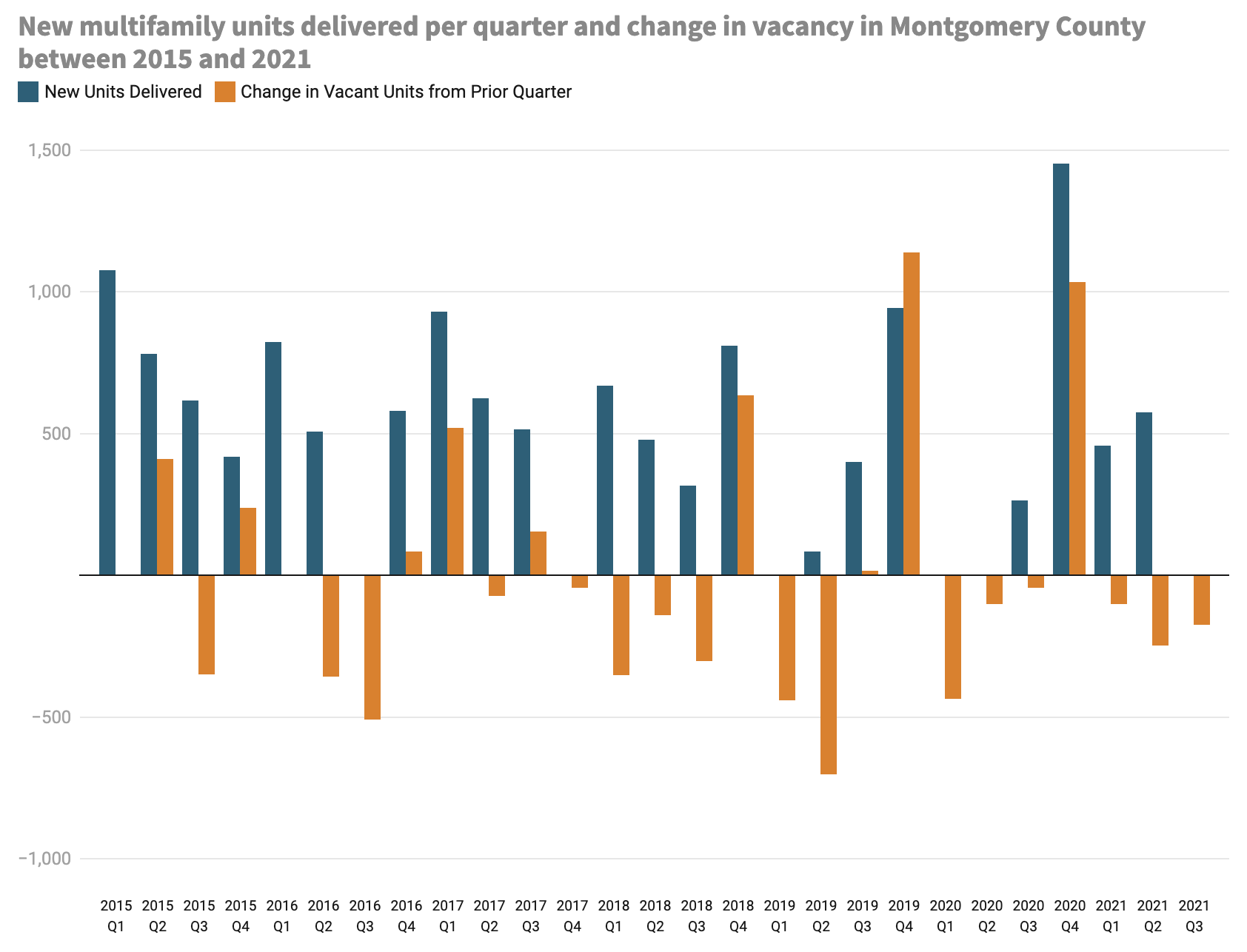

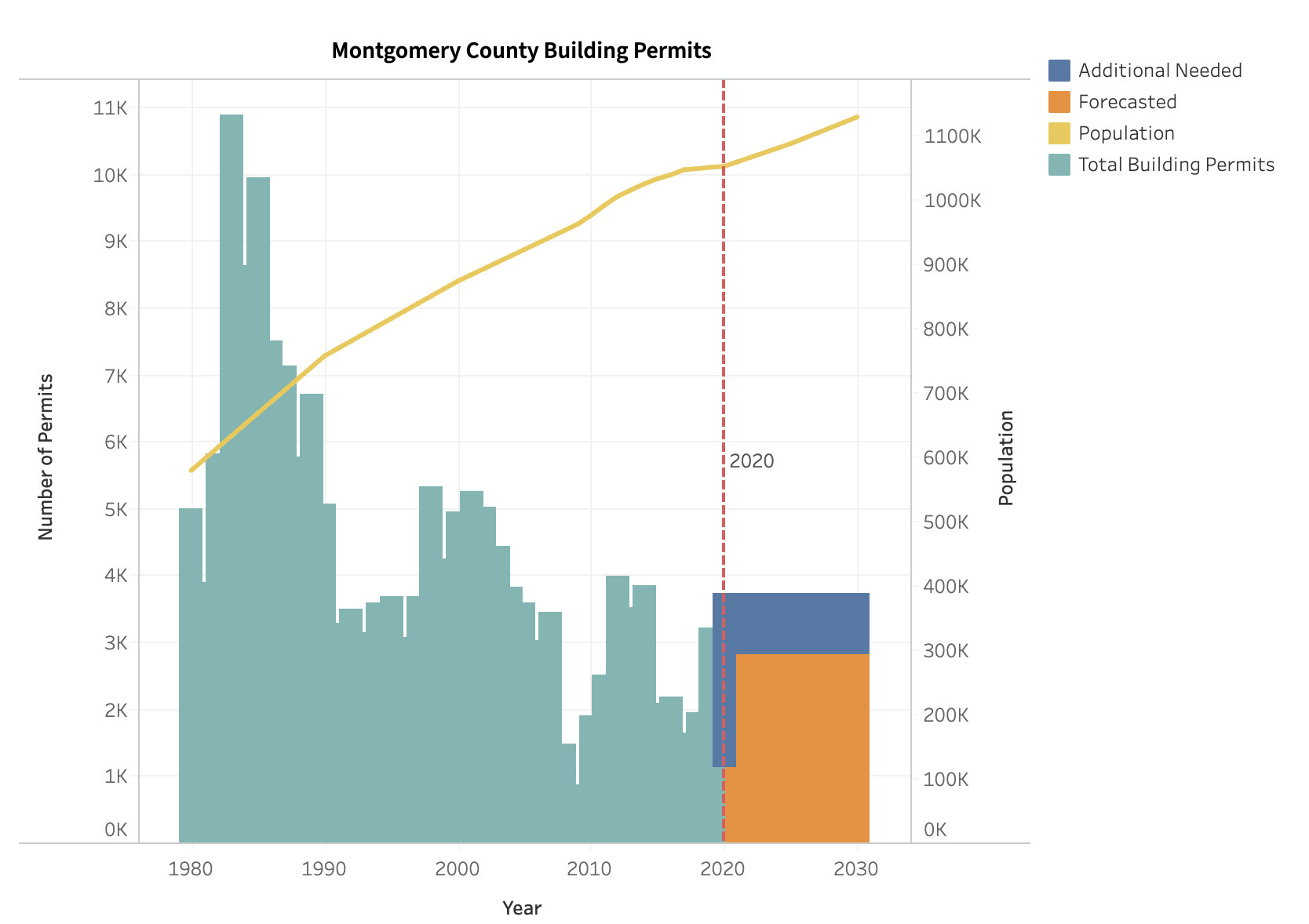

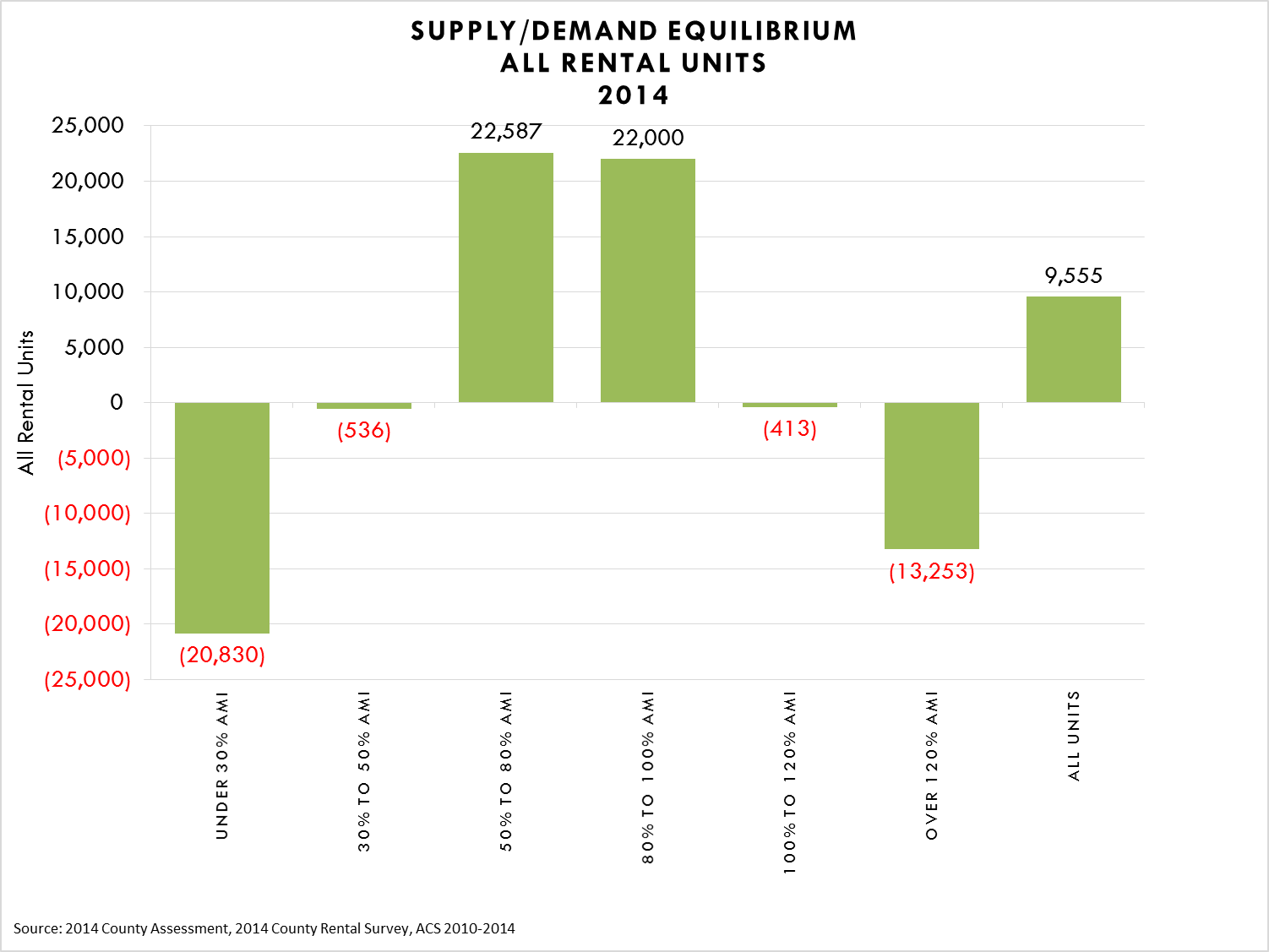

It has been widely reported that Montgomery County is facing a shortage of housing options that meet the size, price, and location needs of our increasingly diverse population. This issue is not specific to Montgomery County—places across the country are looking to expand housing types in their area.

To better understand what other regions have done to make homeownership more attainable for their residents, Montgomery Planning held a virtual event during the Montgomery County Planning Board’s February 24 meeting featuring an esteemed panel of housing experts. Called “Lessons learned: A conversation on expanding housing types from across the country,” it featured former Minneapolis City Council President Lisa Bender, HUD’s Regina C. … Continue reading