Initial findings show that Montgomery County’s housing market is unbalanced, particularly for low-income residents

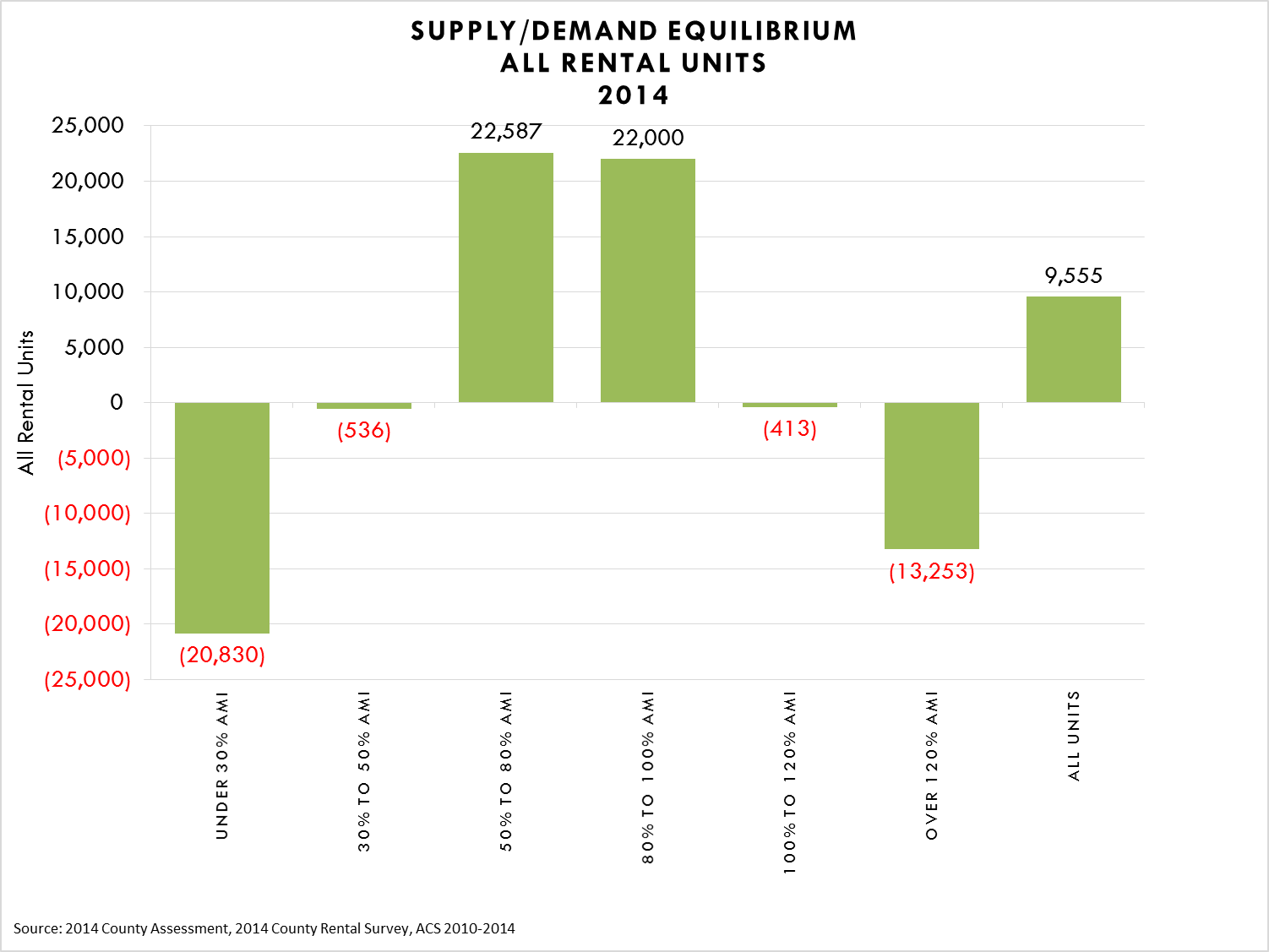

Low income residents in Montgomery County face a shortage of rental units matching their ability to pay, according to an ongoing study of rental housing. So far, the study has found that the existing rental housing market in the county is unbalanced at both the lowest and highest ends of the market. The market is short 20,000 units priced appropriately for households earning less than 30 percent of area median income (AMI) or $28,900. In addition, it is short 13,000 units priced to target households earning more than 120 percent of the area median income or $115,560.

Figure 1.) Supply/Demand Equilibrium for All Rental Units

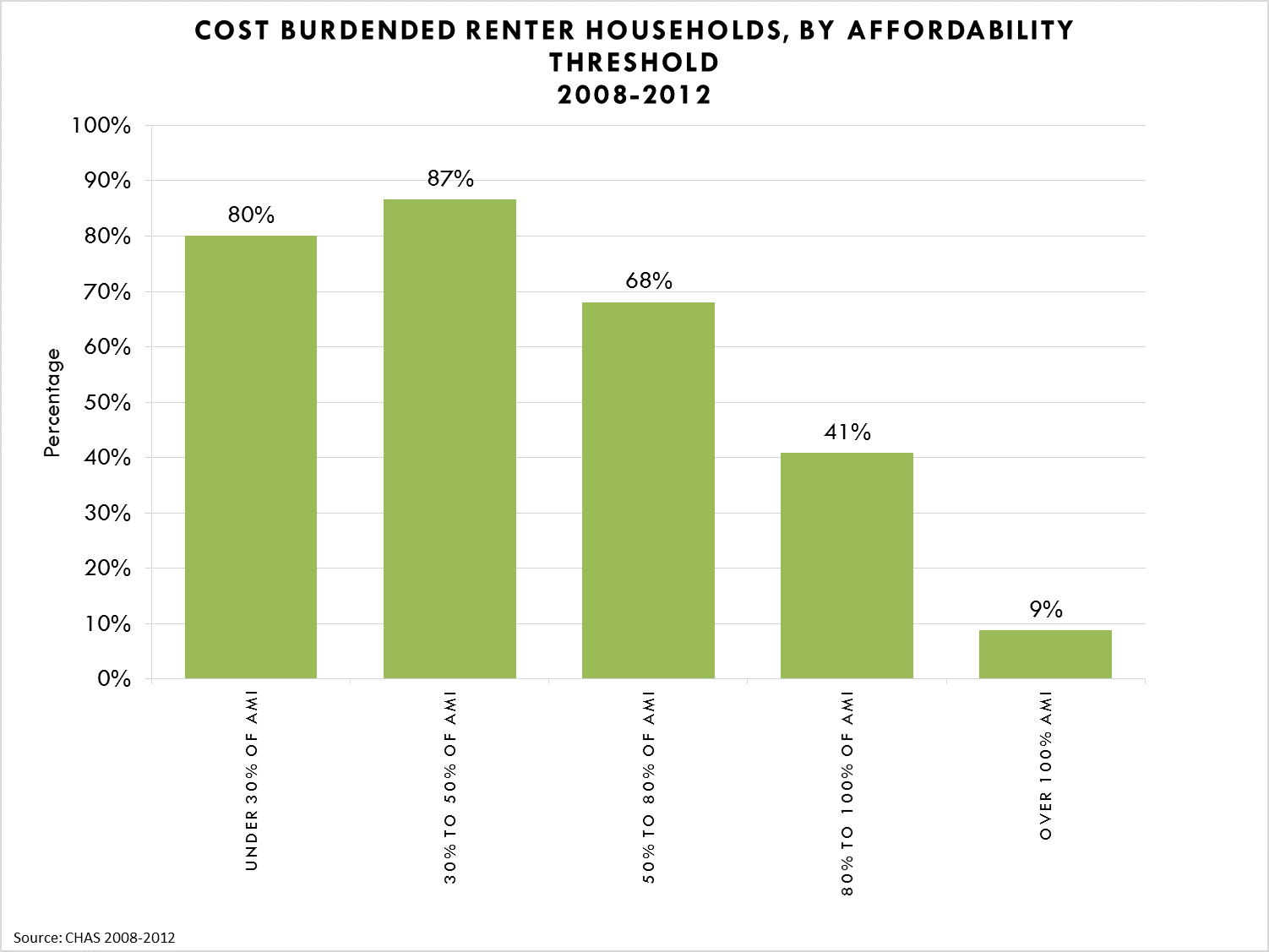

The shortage of rental housing at the high end of the market creates downward pressure on less affluent renters, the study found, because when higher-income households rent less expensive units, lower-income renters have fewer affordable choices. Cost-burdening is linked with this unbalanced market, especially at the lower end of the income spectrum.

Of households earning below 30 percent of AMI, 80 percent of these households are cost-burdened. And 87 percent of households earning between 30 percent and 50 percent of AMI are cost-burdened. In contrast, only 9 percent of households earning more than 100 percent of AMI are classified as cost-burdened.

Figure 2.) Cost Burdened Renter Households, By Affordability Threshold

The study found that the rental market has a net surplus of 44,587 units affordable to households earning 50 percent to 100 percent AMI. The concentration of these units is influenced by the age of the housing stock, as older units are a source of “naturally” affordable housing. The surplus is also influenced by Montgomery County’s mandatory inclusionary zoning requirements for moderately priced dwelling units. The county currently requires a minimum of 12.5 percent of new rental units be set aside for households earning 65 percent of AMI.

The analysis found that rental housing accounts for 30 percent of all housing units in Montgomery County. Most of the rental supply is older, with 55 percent built prior to 1980, and only 14 percent built since 2000.

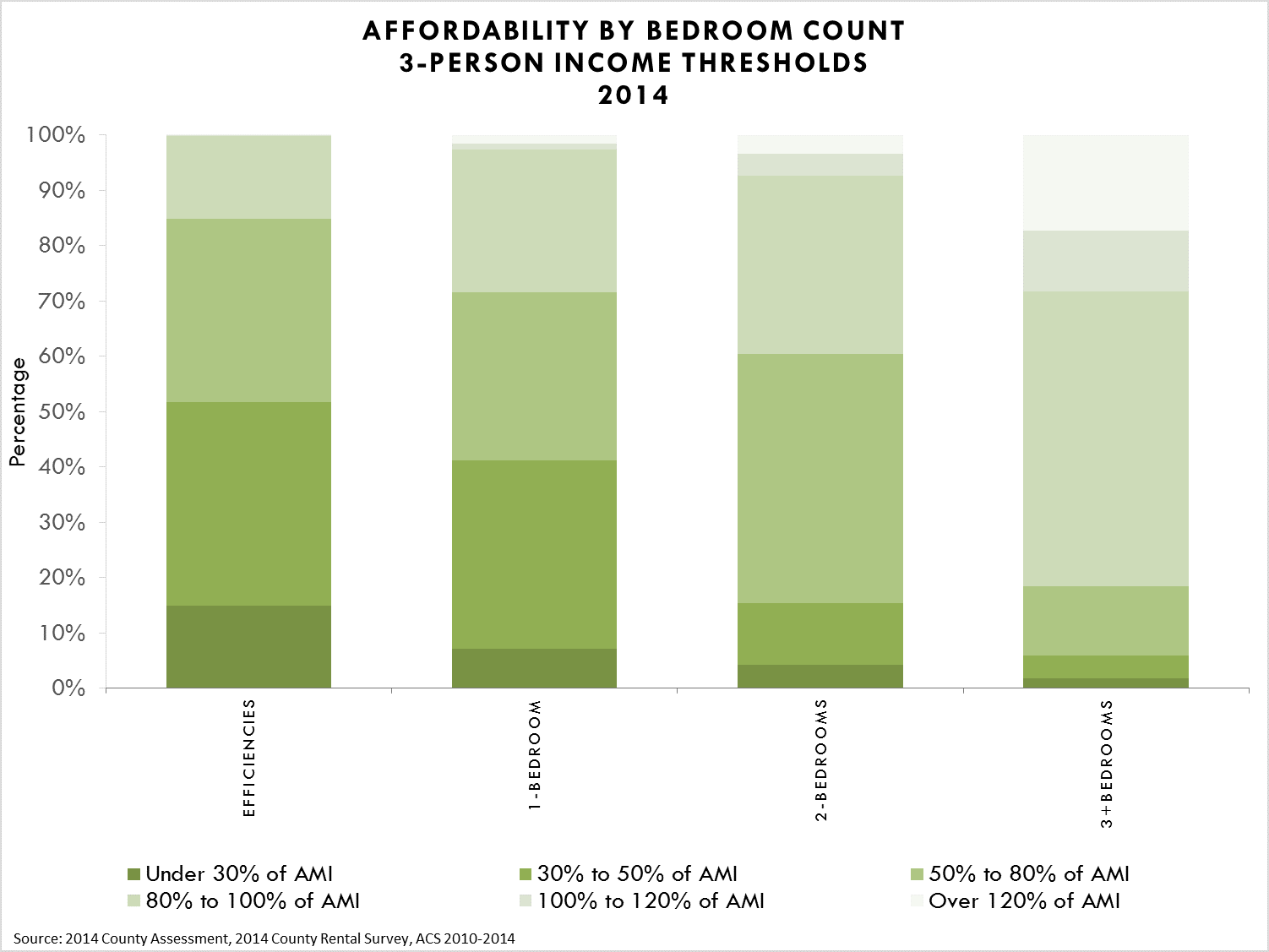

Typical of older properties, the rental housing supply has a high concentration of large units with almost 40 percent having three and more bedrooms. This rate drops to 26 percent if only apartments are counted, excluding single-family homes, which may be more likely to be owner-occupied over the long term.

Figure 3.) Affordability by Bedroom Count, 3-Person Income Thresholds

Affordability is still a concern for larger households needing these larger units. Although 37 percent of renter households have at least three persons, only around 12 percent of three-plus bedroom units are affordable to households earning below 80 percent of area median income (AMI). Smaller units are the most affordable, but do not serve the renter population segments with the greatest needs.

The analysis of rental housing supply by affordability threshold in Montgomery County showed that households at the lowest income levels are the least served. Thirty-eight percent of renter households earn under 50 percent of AMI, yet only 19 percent of rental units are affordable to this group.

The final recommendations of the Rental Housing Study will focus on a mix of short-term strategies that Montgomery County can undertake without large commitments of resources. They will also address longer term strategies that require larger financial investments and partnerships with county agencies or the private sector. The study is expected to be completed by spring 2017 and recommendations will be shared with the Planning Board, County Council and public.

For more information about the Rental Housing Study, please go to: montgomeryplanning.org/tools/research/special-studies/rental-housing-study/

Robert Oshel

How is “cost-burdened” defined or determined? Similarly, how is “affordable” or “affordability” defined or determined?