Many real estate analysts and pundits are arguing that offices are becoming obsolete, thanks in large part to workers’ continued post-pandemic demand for hybrid or fully remote work schedules. If this trend persists, planners must grapple with the question: What happens to the vacant space? In this blog, we examine Montgomery County’s office-vacancy trends and the characteristics of highly vacant office space (which we defined as more than 50% vacant). We also look at the possibilities for redevelopment. While vacancy isn’t the only factor affecting possible redevelopment of office space, it is significant and the focus of this blog.

Overall Trend

In just the past three years, office-space vacancy has increased dramatically in Montgomery County. Vacancy rates in 2022 were the highest of any year since data vendor CoStar started publishing commercial real estate metrics in 1993, and rates increased by almost 5 percentage points since the start of the pandemic in early 2020 (see Figure 1). The height of the pandemic in 2020 and 2021 caused monumental shifts to fully remote work for most employers, but office lease agreements drive office-vacancy rates and many of those agreements were still in their pre-pandemic status.

Figure 1. Office Vacancy Rate, Q1 2020 to Q4 2022

The demand for office space has not disappeared, but it is changing. In particular, businesses and organizations agree that there is demand for office space in modern buildings in urban areas with amenities and transit access. Well-designed modern buildings, with spaces for collaboration and socialization, help draw workers to the office, even if only for a few days a week. Since the start of the pandemic in Q1 2020, there has been net positive leasing activity1 (i.e., tenants leasing space exceeded tenants vacating space) in Montgomery County office buildings built after 2015, including over 80 percent of office space in buildings built since 2020 despite above average rents (Figure 2).

Figure 2: Absorption (%) by Year Built

Highly Vacant Space

The Montgomery County office-vacancy rate is increasing overall in every part of the county, but some areas have more vacancy than others. CoStar identifies 1,527 office buildings in Montgomery County, but it only has vacancy data on 418 buildings. That doesn’t mean the remaining 1,109 office buildings are 100 percent occupied, it simply indicates that CoStar does not know how much of the space in the building is occupied or vacant. Notably, buildings without vacancy data tend to be smaller buildings, averaging 30,000 square feet compared to the overall average office-building size of 65,000 square feet.

Figure 3 shows the distribution of office buildings by vacancy rate. Combining the data atop the first three bars on the left, Figure 3 shows 289 of the 418 Montgomery County office buildings with listed vacancy are less than 30% vacant. Since we are using vacancy to consider redevelopment potential, it makes sense to focus on buildings that are very vacant. There are 52 buildings in Montgomery County that are at least 50% vacant, accounting for a little over ten percent of buildings with reported vacancy. The average vacancy rate in these buildings is 76%.

Figure 3: Office Buildings by Vacancy Rate, Montgomery County

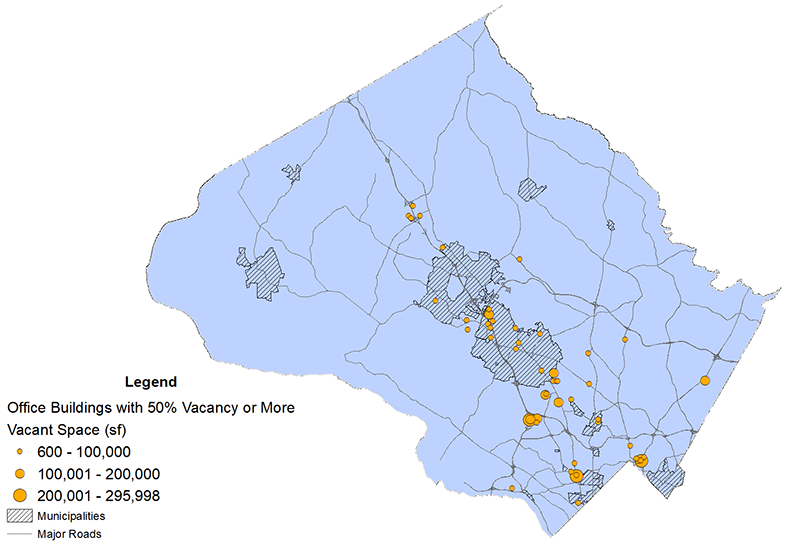

Figure 4 maps the highly vacant buildings, revealing several clusters including Silver Spring, North Bethesda, and North Rockville. Most of North Rockville’s highly vacant buildings are within Rockville city limits.2 Two properties just outside city limits are new life sciences lab developments that are currently leasing up, meaning they are unlikely to remain highly vacant. Similarly, the large vacant building in downtown Bethesda is the newly constructed Avocet Tower and is still leasing up. The former Discovery Headquarters in downtown Silver Spring has over 270,000 square feet of vacant space, but the property is also actively leasing up and its main tenant, the Children’s National Hospital Corporate Office, has a signed lease through 2034.

Figure 4: Map of Office Buildings with 50 Percent Vacancy or Higher

Source: Montgomery Planning, Research and Strategic Projects 2023.

Recent Redevelopment Projects

For some insight into what redevelopment can yield, let’s take a closer look at two office buildings in different parts of the county that have redeveloped or are undergoing redevelopment.

Property 1: Octave 1320 (1320 Fenwick Street, Silver Spring)

The Octave 1320 is an example of an office-to-residential conversion. The nine-story, 102-unit condominium brought new housing to downtown Silver Spring in 2015 and upgraded the design of the building. The condos were designed to be affordable to first-time homebuyers, initially priced in the $200,000s for one-bedroom units, and $300,000s for two-bedroom units. This project was completed in just 12 months, as opposed to 18 to 24 months for new construction and avoided demolition and site preparations expenses. The project also did not require a site plan, saving the developer time and money by avoiding the entitlements process. Not all office properties will be endowed with the necessary structure and convenient location for infill redevelopment that Octave 1320 benefitted from, but the project does demonstrate that office redevelopment can be attractive to a developer and provide improved uses for the public.

Property 2: Old Marriott Headquarters/ELP Bethesda at Rock Spring (10400 Fernwood Road, Bethesda)

The former (and empty) Marriott Headquarters in the Rock Spring area has an approved sketch plan for the development of a 2 million square foot retirement community consisting of independent senior living, assisted care facilities, skilled nursing units, and limited retail. The project will also include public open space, a linear park, and an urban park totaling over 11 acres. The applicant has approved site plans for the first two of three phases in the project, which will include the urban park, although the applicant has not yet pulled a building permit as of this writing. The applicant is also retaining the existing structured parking garage on the site, reducing their costs, and minimizing construction and demolition impacts. This project provides a mix of uses, improves the streetscape, increases park access, takes advantage of existing infrastructure, and provides housing for a growing segment of county residents.

Will any of the highly vacant office buildings redevelop any time soon? Answering that question is an art and a science. There are some metrics, like population, employment, and rent growth that can indicate redevelopment potential, but even with positive indicators, it can be hard to fully understand what property owners are willing to do with their site. Some are comfortable collecting rents even if much of their building is empty, while others might be waiting to sell to the highest bidder who will redevelop the site. In any case, it is clear there are sites in Montgomery County that are underutilized today under the existing zoning, and it’s clear that it can be done. A strategy to promote redevelopment could reap significant benefits to the community in terms of greater housing access and affordability, placemaking, improved multi-modal connectivity, higher sustainability standards, integration into the public realm, and a greater mix of uses.

1 Leasing activity is also known as absorption. Net positive absorption means more space was leased than vacated in a given period, while net negative absorption means more space was vacated than leased.

2 The cities of Rockville and Gaithersburg are outside Montgomery Planning’s jurisdiction

About the author

Bilal Ali is a planner and real estate researcher with the Montgomery County Planning Department. He was a senior associate at BAE Urban Economics before coming to Montgomery Planning in 2022. Since 2021, he has supported the University of Maryland School of Architecture, Planning, and Preservation’s Partnership for Action in Sustainability (PALS) program. Bilal is also an adjunct lecturer teaching Principles, Process and Politics of Planning for Real Property Development at the University of Maryland Colvin Institute for Real Estate Development. Bilal earned his master’s degree in Community Planning in 2019 from the University of Maryland, College Park and graduated from the University of Rochester in 2014 with a Bachelor of Arts in Political Science.