I like to revisit posts I have done. Not long ago I wrote about putting a value on historic preservation. Three recent developments bring me back to the subject. First, the Historic Preservation Commission recently approved 39 applications for the county’s historic preservation tax credits. The 39 projects represent nearly $1.5 million in private investment in historic properties in communities across the county. This is a good thing. As discussed in the previous post, money spent on historic preservation projects demonstrates a strong multiplier effect, making investments in historic rehabilitation particularly beneficial for local economics, jobs and businesses. The number of tax credit projects also bears note. The 39 projects represent perhaps a quarter, or less, of the projects that were eligible for tax credits this past year. This is a bad thing. This number is way too low. Clearly we need to be doing more to make people aware of the credits. We want to encourage more investment in our historic buildings, so both property owners and the county will benefit. Making more people aware of the tax advantages of historic preservation is one way to do this. We are trying, and we would appreciate your ideas on creative ways to reach people.

This brings me to the second development. The County recently enacted a bill increasing the county rehabilitation tax credits to 25 percent, up from 10 percent. 25 percent. This is a huge incentive, and benefit, for owners of historic properties. How’s that for encouragement? We hope that more people will take advantage of the 25 percent credit by investing in their historic properties, thereby strengthening Montgomery County’s economy.

State and federal historic preservation tax credit programs can extend the benefit of county tax credits.

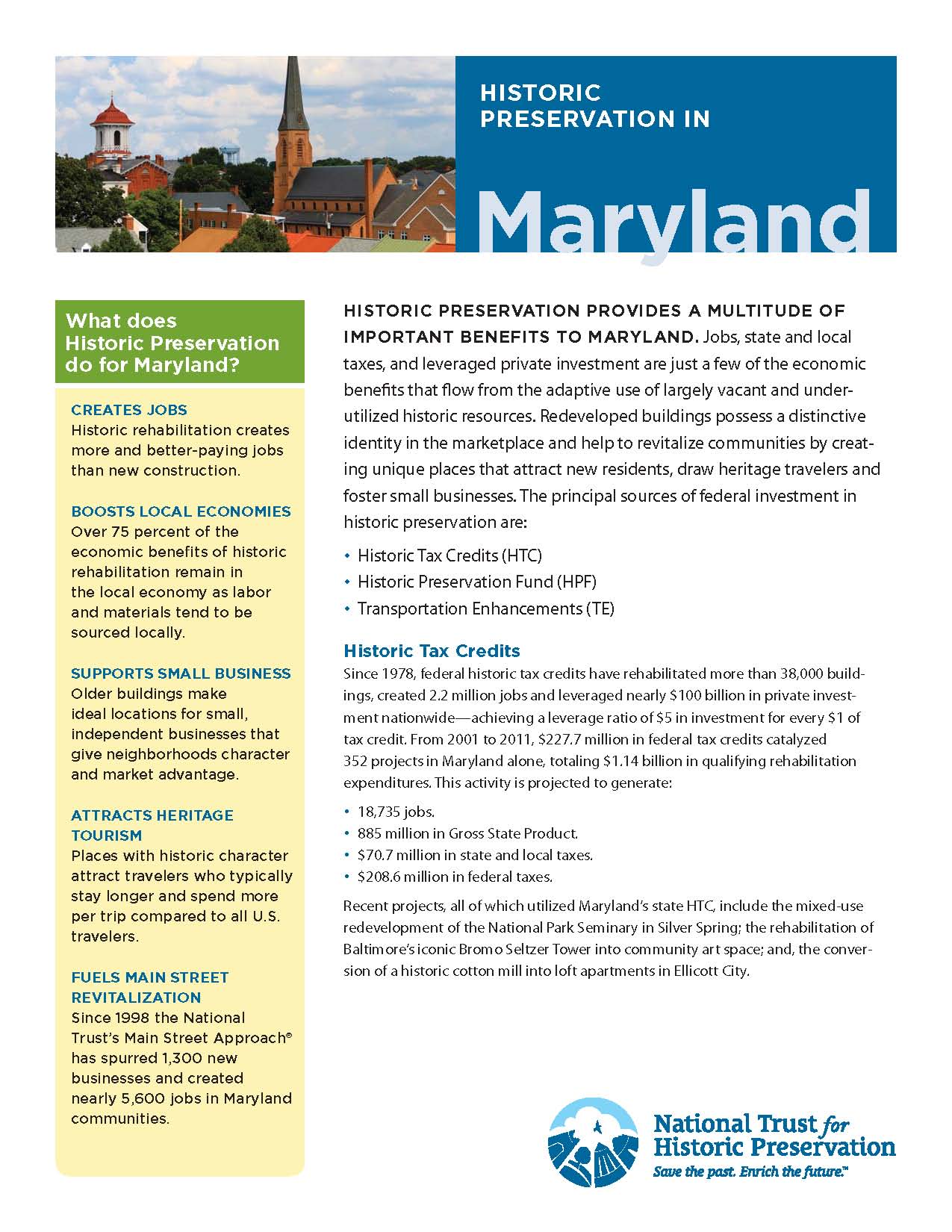

Against this backdrop of the economic benefits of preservation tax credits, I turn last to the extraordinarily effective federal historic preservation tax credit program, which is currently threatened by the broader debate over tax reform. Although not widely used in Montgomery County, federal historic preservation tax credits (along with state and county credits) have contributed to the viability of a handful of projects, including the redevelopment of the National Park Seminary, widely regarded as one of the most important historic preservation and community development projects in Maryland. The National Park Seminary project put the long vacant and derelict property back on the tax rolls with nearly 300 housing units, saving a remarkable historic resource in the process. It is hard for me to understand how getting rid of the federal historic preservation tax credit program could be called reform, particularly when you look at the numbers.